Giving from your income is often the first thing people think of when considering giving. In addition to giving income, you can convert non-cash items into cash donations to give, or in some cases, give those non-cash items directly.

Real Estate

Investments

*Tax implications are an important consideration for givers of these gifts. Always consult your CPA, tax attorney, or licensed financial advisor.

If you would like more information about donating personal assets to Building Waymaker.Church, please email finance@waymaker.church

You move it, store it, insure it, and dust it. We all have those things in our home. Do you have collectibles, valuable heirlooms, or antiques that could be contributed to the church for sale? This could include: automobiles, jewelry, antiques, sports memorabilia, and collections of value (stamps, baseball cards, coins, etc).

If you have hidden treasure that you would like to donate to Building Waymaker.Church, please email finance@waymaker.church

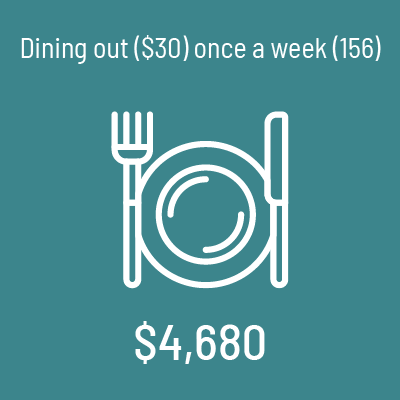

What are those things that you could give up in order to give more to Building Waymaker.Church? Is it that daily Starbucks drink? Cable TV? Choosing to give up one or more of these simple things could add up to significant contributions over three years.

The possibilities are endless. Use the calculator below to calculate what you could donate by giving up a certain amount each week.

Now that you know of some creative ways you can give over the next three years, we invite you to make your commitment to Building Waymaker.Church.